Despite the continuing atmosphere of optimism and denial (that’s par for the course during long-lived counter-trend rallies), we are witnessing a slow-motion crash of the juggernaut that is the real US economy. The unemployment situation is already the worst since the Great Depression and showing no signs of recovery.

David Rosenberg provides his take on the data from the latest Bureau of Labor Statistics report:

Just How Ugly Is The Truth Of America’s Unemployment

The data from the Household survey are truly insane. The labour force has plunged an epic 764k in the past two months. The level of unemployment has collapsed 1.2 million, which has never happened before. People not counted in the labour force soared 753k in the past two months. These numbers are simply off the charts and likely reflect the throngs of unemployed people starting to lose their extended benefits and no longer continuing their job search (for the two-thirds of them not finding a new job). These folks either go on welfare or they rely on their spouse or other family members or friends for support.

The middle class is forced to run on a treadmill that is increasing in speed, so that they have to run faster and faster just to keep up. More and more people are failing to do so and being flung off the back all the time, but so far their plight goes largely unnoticed. For now there are sufficient bread and circuses to distract the rest of the masses, and enough opportunities for short-term profit for those at the top of the pyramid to focus their attention away from reality as well. In the meantime the pressure builds quietly closer to criticality, and as we’ve seen recently in Egypt, a social pressure cooker can suddenly erupt. Prevailing social mood can turn on a dime.

As bad as unemployment is now, it is destined to get vastly worse, likely at an accelerating pace. The real economy is facing a squeeze from both ends that stands to get dramatically worse, as we move into the next phase of the credit crunch and the effective money supply begins to shrink in earnest (deflation). Many employers are already having difficulty maintaining salaries and benefits, and many employees are struggling with a rising cost of living that leaves them increasingly stretched. This is before credit contraction moves into high gear, as it will once the rally is over.

The relative optimism of a rally keeps both sides hanging on, hoping that the hard times are temporary and that greener pastures lie around the corner. When that optimism evaporates, and those hopes prove to be unfounded, the reaction could be rapid, especially on the part of employers. Those who have been trying to kick the can of current difficulties down the road far enough for recovery to get underway are very likely to hit a wall, especially if postponing the inevitable has been achieved by digging themselves into an even deeper hole in the meantime. The likelihood of a spike in unemployment in the not too distant future is very high.

The public sector is particularly vulnerable, as the crunch is already becoming acute in many places. Public sector employees have been offered relatively generous terms, especially for benefits such as pensions, but the ability of public authority employers to keep those promises hinges on maintaining tax revenues, and that is already proving to be impossible at both the municipal and state levels. Mechanisms are being sought to walk away from these promises-that-cannot-be-kept, which compete with essential social functions for increasingly scarce revenues, as Mary Williams Walsh noticed in the New York Times last month:

A Path Is Sought for States to Escape Their Debt Burdens

Policymakers are working behind the scenes to come up with a way to let states declare bankruptcy and get out from under crushing debts, including the pensions they have promised to retired public workers [..]

Beyond their short-term budget gaps, some states have deep structural problems, like insolvent pension funds, that are diverting money from essential public services like education and health care [..]

Bankruptcy could permit a state to alter its contractual promises to retirees, which are often protected by state constitutions, and it could provide an alternative to a no-strings bailout. Along with retirees, however, investors in a state’s bonds could suffer, possibly ending up at the back of the line as unsecured creditors.

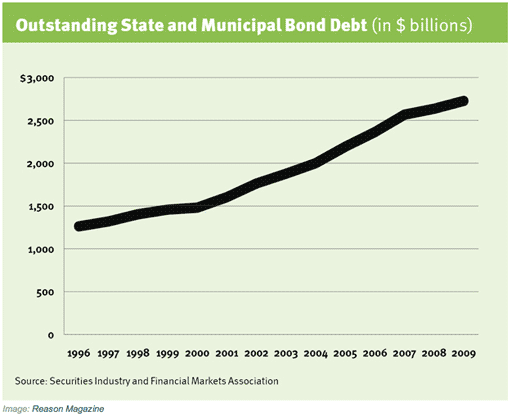

The parallels between muni bonds and the housing bubble are significant, notably the shift in perception from low risk to high risk in a short period of time. Says Veronique de Rugy for Reason Magazine:

The Next Housing-Style Crisis Will Be The Municipal Debt Bubble

Like homeowners, states and cities splurged on debt and found inventive ways to get around borrowing limits to finance projects they couldn’t pay for otherwise. And recently the federal government encouraged investors to pour their money into the coffers of these less-than-creditworthy borrowers. Now some of those investors, like the few lonely mortgage-industry short sellers in 2005–06, have started betting against the borrowers. Time reports that some of them “are jumping into the credit default swap market to bet against cities, towns and states”.

Municipalities, which have been borrowing for years to fund spending of all kinds, are shortly going to find it very much more difficult to access the money they would require to maintain their current spending. We are already seeing large scale layoffs in many places, and this is the thin end of the wedge. Tami Luhby at CNN:

Camden, N.J., to lose nearly half its cops

There will be fewer cops patrolling the streets of Camden, N.J., come Tuesday. Struggling to close a $26.5 million budget gap, the city with the second highest crime rate in the nation is laying off 163 police officers. That’s nearly 44% of the force. And Camden will also lose 60 of its 215 firefighters. Some people with desk jobs will be demoted and reassigned to the streets. The mayor’s office says that the cuts will not affect public safety.

This assurance is highly optimistic considering recent experience elsewhere. Jerry White at WSWS wrote back in September:

Detroit firefighters denounce city budget cuts

A virtual firestorm erupted Tuesday night, destroying or severely damaging 85 homes, garages and other structures and leaving dozens of families homeless. Burning debris and embers were blown by winds spreading flames house-to-house and across streets and alleys. Shorthanded and under-equipped firefighters, grappling with malfunctioning hydrants and exhaustion, fought to protect lives and property. They were aided by residents desperately fighting back the flames with garden hoses [..]

In a press conference Wednesday, Detroit Mayor David Bing sought to deflect attention from the crippling budget cuts imposed on the fire department and other city services….In reality, cutbacks carried out by Bing and previous Democratic administrations had a direct impact on the severity of the fires and the damage they wrought. Between 8 and 12 of the city’s 66 fire companies are “browned out” each day, meaning they are temporarily decommissioned and unavailable to fight fires due to budget cuts. One of the decommissioned stations was reportedly the closest to a neighbourhood that erupted in flames. Residents complained of long delays while waiting for fire engines, even running to nearby firehouses that were empty.

Our societies face many hard choices as to priorities in our developing era of broken promises to ourselves and each other. We cannot have it all. Both employers and employees are caught between a rock and a hard place (as are those they serve with their activities). So far the hard choices are being avoided, but that does nothing but compound the inevitable pain. Desperation measures such as encouraging gambling in order to gain revenue from social addictions is clearly not a solution. Neither is selling future revenue streams to pay current bills. Consistently failing to pay those bills is reminiscent of the collapse of the Soviet Union, where employees were paid months late if at all.

Illinois is in particularly bad shape. Cue Steve Kroft at CBS’ 60 Minutes:

State Budgets: The Day of Reckoning

Hynes is the [Illinois] paymaster. He currently has about $5 billion in outstanding bills in his office and not enough money in the state’s coffers to pay them. He says they’re six months behind.

“How many people do you have clamouring for money?” Kroft asked. “It’s fair to say that there are tens of thousands if not hundreds of thousands of people waiting to be paid by the state,” Hynes said.

Asked how these people are getting by considering they’re not getting paid by the state, Hynes said, “Well, that’s the tragedy. People borrow money. They borrow in order to get by until the state pays them.” “They’re subsidising the state. They’re giving the state a float,” Kroft remarked. “Exactly,” Hynes agreed.

“And who do you owe that money to?” Kroft asked. “Pretty much anybody who has any interaction with state government, we owe money to,” Hynes said. “The state’s a deadbeat,” Kroft remarked.

And Tim Jones for Bloomberg:

Illinois Has Days to Plug $13 Billion Deficit That Took Years to Produce

“Illinois is probably in the worst shape,” Gross said in a Dec. 28 interview on CNBC. The widening gap between Illinois’s expenses and revenue drew criticism from Moody’s. The disparity underscored the state’s “chronic unwillingness to confront a long-term, structural budget deficit,” it said in a Dec. 29 study.

The worst financial crisis since the Great Depression and politicians’ unwillingness to cut budgets explain the descent since 2008, said Tom Johnson, president of the nonpartisan Taxpayers’ Federation of Illinois. Annual sales and income-tax revenue fell for the first time in modern history, he said. “The state was hoping for a quick recovery or inflation, and they didn’t get it,” Johnson said in a telephone interview. “And there was no appetite to reduce the escalating costs of spending.”

The falloff in revenue aggravated the state’s historic practice of delaying payments to vendors and carrying those costs on from one year to the next. “Revenues went south, spending went north,” Johnson said. “It’s unsustainable.” The current-year budget deficit of $13 billion is roughly half the size of the state’s general-fund budget. Borrowing to pay bills continues. In November the state sold $1.5 billion of bonds backed by tobacco settlement payments to help pay vendors.

“We have seen a lot of the budgetary tools that really don’t qualify as real solutions used, whether it’s short-term borrowing, pension borrowing, delays in payments, the sale of future revenues,” Hynes said. Illinois business leaders have warned that the state’s failure to properly fund pensions means the plans will run out of money to pay promised benefits before the decade ends.

The common ground where bargains acceptable to both sides of a dispute can be found is rapidly disappearing or already gone. All parties are looking for more in order to dig themselves out of a hole, when there is much less overall to go around. This creates a clear potential for an entrenched and confrontational mentality that can easily make matters worse.

Unfortunately deflation (the collapse of money plus credit relative to available goods and services) aggravates natural human impulses arising out of increasing scarcity. Under deflationary conditions, where credit can evaporate at lightning speed, the purchasing power of very scarce remaining physical cash increases. In other words, over time, a salary would go further than it used to, or alternatively the purchasing power of a salary could be maintained if the salary was cut. Employees would be very unlikely to see a salary cut in those terms however, and would likely become very defensive. People typically think in nominal terms, not in real terms, even though it is affordability that matters rather than merely price.

Squeezed employers are not going to be able to maintain the purchasing power of the salaries they pay. They will be looking to pay fewer people and to hand over less purchasing power to each remaining employee than before. Employees will have little or no bargaining power, either individually or collectively, under circumstances where unemployment is high and rising (for a very evocative illustration of this in relation to the Great Depression see John Steinbeck’s The Grapes of Wrath).

The odds of very substantial pay and benefit cuts in the not too distant future are very high, and the odds of this being extremely badly received by the workforce are even higher. We could see many more public sector employers trying to pay their bills in IOUs, as California resorted to during phase one of the credit crunch.

At the moment employees are watching prices rise (as a lagging indicator of previous expansion coupled with commodity market speculation), and in many places they are facing tax increases and/or the introduction of service user fees at one or more levels of government. While prices are likely to fall in a deflation, this will not mean greater affordability where people’s purchasing power is falling faster than price due to rapidly falling wages and benefits, so the rise in the effective cost of living will continue, and so will the pain.

So far interest rates are still moderate, which matters a great deal to heavily indebted individuals, but this is not likely to remain the case for too long as lenders face higher risk of non-payment. The typical reaction, apart from drastically curtailing lending, would be a higher risk premium placed on credit. Debt will become much less serviceable as a result. The burden on ordinary people, as almost everything gets less affordable, will be a heavy one indeed.

As we have written here before, there is considerable potential for war in the labour market. It is entirely likely that we will see general strikes, and a considerable amount of unrest, which can in turn trigger a repressive response. There are many commenters who take one side or the other in calling for a solution to the employment predicament, but that is too simplistic. Blame games serve no one (except nascent demagogues).

We have built our civilisation on an unstable tower of promises. We have all been part of the problem, and now we must all look for ways forward that cause the least harm to the fabric of society. There are no ‘solutions’ in that there is nothing that will get us business as usual, but there are better and worse ways to address the intractable situation we are facing.

Unions are a favourite target for criticism. They are only one side of the story, but they are major players. Steve Maich for Macleans:

Are labour unions a blessing or a curse?

Despite arguments to the contrary, this economic muddle wasn’t triggered because ordinary Americans don’t make enough money or because they lack adequate job protection. It wasn’t sparked by big businesses being saddled with high labour costs or debilitating strikes either. Our problems are rooted in the fact that ordinary Americans spent wildly beyond their means for more than a decade, and big business rode that debt-fuelled spending boom until it crashed.

The union movement has done a lot over the last hundred years to redress a balance of power that had enabled the Dickensian exploitation of the masses, but now has the potential to be a significant obstacle to what must happen going forward, namely financial haircuts for all parties. It will not be possible, nor is it desirable, to defend the rights of one group at the expense of all others, and all competing priorities for public expenditure.

Pressing the case for one segment of society only would be extremely divisive, particularly between working people. Where unions exist to maintain large disparities between workers through closed shops with substantial barriers to entry, they act to benefit a few relatively privileged workers at the expense of the many, not to redress the balance of power between the top and the bottom of the pyramid. As such they become self-serving, as most human institutions typically do over time.

They can also be used by the powerful as a tool to divide and rule. As Ilargi said at The Automatic Earth some time go, We’re going to play you all against each other, until you make as much as a Chinese peasant. This clearly does nothing to advance the cause of working towards a more just society, as unions claim to do.

As high unemployment will undercut bargaining power, unions are not likely to survive in their present form. If they cling to rigid demands based on promises made in manic times, they will be broken. This is a recipe for a return to outright exploitation under conditions where desperate people have no choice. It would be far better to leave behind that which cannot survive and work to find any kind of common ground that could be built on. Such ‘solutions’ are not likely to please anyone, as having to accept less never does, but it would be better than fighting the inevitable.

Looking for ways to move forward during a period of contraction will be of major importance in almost every sphere of society. Those with mediation skills, who can help to identify the least worst approach for all concerned, could be worth their weight in gold. I would expect it to be a thankless task, given how patently unrealistic most people’s expectations are, but if it can help to avoid our societies making a bad situation worse as expensively as possible, then it will be well worth the effort.