In this era of global bubble-blowing we have seen speculative fever flourish in relation to many different asset classes. At the peak of a bubble the euphoria can be palpable, and the perception that ‘it’s different this time’ confers a sense of invulnerability that justifies throwing caution to the wind.

Speculators cease to worry about how much they pay for an asset, since they think someone else will always pay more later. Unfortunately for those caught up in powerful swings of herding behaviour, it’s never different this time. Boom inevitably turns into bust, because the supply of Greater Fools is not infinite after all.

Speculative financial flows seeking ‘alpha’ can overwhelm important sectors of the real economy. Price, driven by perception rather than by reality, significantly over-reaches the fundamentals. Demand is artificially brought forward. That apparent demand drives considerable mal-investment and a pathological level of risk-taking. When the bubble reaches its maximum extent and implodes, speculation moves into reverse and the sector is dumped.

The artificial demand stimulation disappears, leaving a demand vacuum. The scale of the mal-investment becomes obvious, and prices head for a significant undershoot of the fundamentals. A bubble that created virtual wealth temporarily, leaves very real economic wreckage in its wake. When a critical economic sector is affected, the fallout can be very painful.

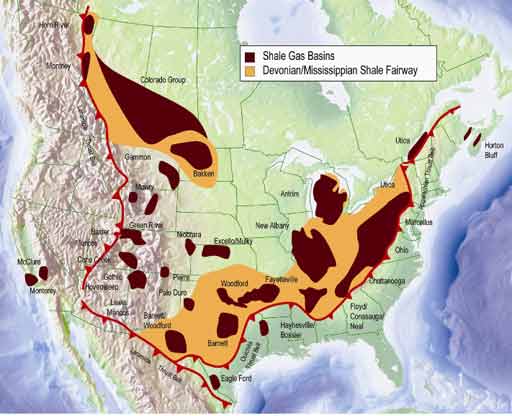

We have been witnessing just such a dynamic playing out in the North American natural gas market in recent years, with a particular focus on the shale gas that is touted as being the key to energy independence. The hype over a supposed 100 year supply of cheap, clean energy has been pervasive. Vast sums of money have been committed as a result, despite very little critical evaluation of the real world prospects, at least in the public domain.

Thankfully there have been a few sober voices in the wilderness who were prepared to challenge the received wisdom, most notably Arthur Berman (whose superb work can be found at The Oil Drum) and Canadian gas expert David Hughes.

Conventional supplies of natural gas peaked 10 years ago, and concern over supply began a few years later. Considering that natural gas provides some 20% of electricity and 60% of home heating (more in the north east), it is not surprising that apparently imminent supply problems would have been a cause for concern. A particularly good review of the situation at the time can be found in Julian Darley’s 2004 book High Noon for Natural Gas.

Unconventional gas sources (shale gas, coal bed methane and tight formation gas) have since appeared to be game-changers, and game-changers can restore complacency remarkably quickly. But, appearances can be deceiving, and complacency is dangerous.

Energy independence is the Holy Grail of what passes for energy policy in the US. The last 8 presidents have all stressed its importance, but none has been able to do anything about a growing dependence on energy imports, many from unstable parts of the world, or from energy exporters with increasing domestic demand who are well along the depletion curve themselves. There have been speeches on the value of ethanol and other biofuels, along with incentives for their production, but a conviction that energy independence might actually be achievable only really seemed to emerge with in recent years in relation to shale gas.

Apart from the policy windfall, an apparent gas bonanza offered the potential for lucrative financial returns (especially on land speculation), and it allowed environmental organisations to support gas as a transitional fuel on the path to a renewable energy future. Across the board support for shale gas was virtually guaranteed. However, strong consensus is always a red flag, as we have discussed many times here at The Automatic Earth. The stronger the consensus, the more it pays to question what so many uncritically hold to be true. It is clearly time to take a more in-depth look at the real prospects for natural gas in North America.

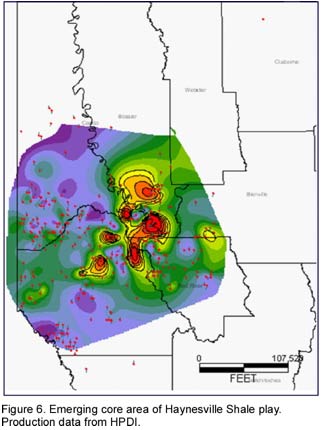

Geologist Arthur Berman has been the most prominent public critic of shale gas. His major points of contention lie in the companies ‘manufacturing model’, their extrapolation of gas reserves, the implication of rapid decline rates, and the destruction of shareholder value as the numbers simply do not add up. The ‘manufacturing model’ utilized by the gas companies asserts that all parts of a gas play are equal, so that one may drill anywhere with comparable success. Extrapolating from the few most successful wells yields reserve estimates that Mr Berman feels are hugely inflated. He demonstrates that all shale gas plays contract to a core area, typically representing no more than 10-20% of the original area.

In addition to there being relatively few ‘sweet spots’ in shale plays, Mr Berman also points out that shale gas wells show much more rapid depletion rates than conventional natural gas wells (65-85% in the first year, as compared to 25-40%), and that this has an inevitable impact on extrapolations of recoverable gas supplies. In his view, the shale gas resource is vastly less than the estimates that have entered the public consciousness:

I recently grouped all the Barnett wells by their year of first production. Then I asked, of all the wells that were drilled in each one of those years, how many of them are already at or below their economic limit? It was a stunning exercise because what it showed is that 25-35% of wells drilled during 2004-2006 – wells drilled during the early rush and that are on average 5 years old-are already sub-commercial. So if you take the position that we’re going to get all these great reserves because these wells are going to last 40-plus years, then you need to explain why one-third of wells drilled 4 and 5 and 6 years ago are already dead [..] If you investigate the origin of this supposed 100-year supply of natural gas…where does this come from? If you go back to the Potential Gas Committee’s [PGC] report, which is where I believe it comes from, and if you look at the magnitude of the technically recoverable resource they describe and you divide it by annual US consumption, you come up with 90 years, not 100. Some would say that’s splitting hairs, yet 10% is 10%. But if you go on and you actually read the report, they say that the probable number-I think they call it the P-2 number-is closer to 450 Tcf as opposed to roughly 1800 Tcf.

What they’re saying is that if you pin this thing down where there have actually been some wells drilled that have actually produced some gas, the technically recoverable resource is closer to 450. And if you divide that by three, which is the component that is shale gas, you get about 150 Tcf and that’s about 7 year’s worth of US supply from shale. I happen to think that that’s a pretty darn realistic estimate. And remember that that’s a resource number, not a reserve number; it has nothing to do with commercial extractability. So the gross resource from shale is probably about 7 years worth of supply.

Consistently disappointing results have not so far burst the shale gas bubble, as people seem all too willing to believe the hype without question. This lack of critical thinking is characteristic of bubble psychology. Bubbles are formed as an interaction between predators and willing victims blinded by greed. It’s important to remember that it’s never ‘different this time’.

Art Berman:

Shale play promoters constantly try to divert attention and analysis from current plays to newer plays. Newer plays have less data to analyse and, therefore, reserve claims are more difficult to question. Because the Barnett and Fayetteville shale plays have under-performed expectations, we were invited a few years later to consider the future potential of the Haynesville Shale play. Now that the Haynesville looks disappointing, we are asked to consider the Marcellus Shale play. Since the State of Pennsylvania does not publish monthly production data for analysts to evaluate, no one can dispute or confirm the claims made by operators. With the shift to liquids-rich plays like the Eagle Ford Shale, we are again asked to trust the same promoters that sold us under-performing plays in the past that this time it will be different.

The shale gas bubble is a perfect example of the irrationality of markets, the power of perverse short-term incentives, the driving force of momentum-chasing, the dominance of perception over reality in determining prices, and the determination for a herd to stampede over a cliff all at once. The perception of a gas glut has driven prices so low that none of the participants are making money (at least not by producing gas) or creating value. We see a familiar story of excessive debt, and the hollowing out of productive companies dead set on pursuing a mirage.

Art Berman:

It’s all about production numbers. They call these things asset plays or resource plays; that reflects where many are coming from, because they’re not profit plays. The interest is more in how big are the reserves, how much are we growing production, and that’s what the market rewards. If you’re growing production, that’s good-the market likes that. The fact that you’re growing production and creating a monstrous surplus that’s causing the price of gas to go through the floor, which makes everybody effectively lose money….apparently the market doesn’t care about that. So that’s the goal: to show that they have this huge level of production, and that production is growing. But are you making any money?The answer to that is…no. Most of these companies are operating at 200 to 300 to 400 percent of cash flow; capital expenditures are significantly higher than their cash flows. So they’re not making money. Why the market supports those kinds of activities…we can have all sorts of philosophical discussions about it but we know that’s the way it works sometimes. And if you look at the shareholder value in some of these companies, there is either very little, none, or negative. If you take the companies’ asset values and you subtract their huge debts, many companies have negative shareholder value.

It is interesting to note the effect of hedging in allowing companies to continue pursuing a strategy that destroys value. Being able to play with various sources of someone else’s money, shareholders or otherwise, makes a great deal of difference. That money will be thrown at the latest ‘big thing’ during its expansion phase. But, when that money is taken off the table, the hole in the collective business case will be abruptly revealed. That is when the damage done by financialisation of energy production will really become obvious.

Art Berman:

The companies have been hedged at $7.00 for the past 5 years–they have not been suffering with $3 or $3.50 realised prices. It is against realised prices of $7 that there are no earnings and no shareholder equity. The implied warning in my post is that now, with no hedges of any value available, imagine the future of earnings and shareholder equity.The fact is that the marginal cost is $7, the companies have no earnings and the shareholder has nothing. The manufacturing model has failed and 10s of billions of dollars have been destroyed and continue to be destroyed. I have not asked you to defend your position–what is it, by the way? That we should believe smart public companies because they have bet other people’s money on something that their balance sheets don’t support, but they must be right anyway?

Periods of mania, where whole industries, or even whole economies and societies, collectively take leave of their senses, generate an all-in mentality, with no safety margins and no contingency plan. The flip side of over-shooting the fundamentals during the blowing of a bubble is undershooting them when the bubble implodes, killing investment and potentially rendering most of the industry uneconomic for long enough to eliminate most of the players. Hence an industry elevated far beyond its fundamentals by ponzi finance is also destined to be consumed by it.

Art Berman:

For many companies, there is no turning back–the entire company has been bet on the success of shale plays. This seems to violate what has been learned in the E&P business about the importance of having a balanced portfolio. In some cases, companies do not have sufficient shareholder value to justify being bought and, therefore, saved.

Art Berman is not the only knowledgeable gas industry insider to point out that the emperor has no clothes, although most of the other who share his doubts do so much less publicly. The New York Times recently published a substantial quantity of correspondence that had been sent to them by insiders extremely concerned about bubble dynamics.

No identifying whistleblower details were divulged, so that the criticism remains largely anonymous. Many people have clearly recognised the warning signals of a mania for a long time, yet very little information has emerged in the public domain until too late to preserve much value. Following the herd is the path of least resistance. Failing to do so can easily be a career-limiting move, hence the facade continues until the damage has been done, and the sector hits a brick wall at a hundred miles an hour.

Here are some of the comments from that New York Times piece:

Geologist and official from Anglo-European Energy:

After buying production for over 20 years, hopefully I know the characteristics of great wells (flat decline curves, low operating costs, large production), and as you know, the shale plays have none of these. The herd mentality into the shale will eventually end possibly like the sub-prime mortgage did. In the meantime it is very difficult to sell any kind of prospect that is not a shale play.

Analyst from PNC Wealth Management (2011):

Money is pouring in from investors even though shale gas is inherently unprofitable. Reminds you of dot-coms.

Analyst from IHS Drilling Data (2009):

The word in the world of independents is that the shale plays are just giant Ponzi schemes and the economics just do not work.

Retired geologist for major oil and gas company (2011):

As I think you would agree, we are looking at a bubble here with caveats. The caveats are how corporate hubris and bad science have caused a lot of folks to think that gas is nearly too cheap to meter. And now these corporate giants are having an Enron moment, they want to bend light to hide the truth. The bubble will burst, folks will get run over, reason will be restored, if only temporarily.

Official from Bold Minerals LLC (2010):

1. The players never did any careful regional studies before they made serious and irrevocable capital commitments to the various shale plays. Our scouting sources never got calls for logs or cores on the significant old tests, especially in the Haynesville. This was mystifying2. The pronouncement that the reservoir was uniform and covered 10 or 20 counties or (in the case of Marcellus) 5 states was absolute heresy in the conventional business. This very extravagant claim was never really debated or contested by the technical community. The downhole data for these broad sweeping conclusions was simply never there.

3. The escalation of lease bonuses to ridiculous heights and the taking of 3 year term leases put the companies in the position of being compelled to drill hundreds of potentially technically unsound wells with insufficient downhole information or face massive impairments by letting incredibly expensive acreage expire undrilled. In previous hot domestic plays, no major company would ever commit itself to lease positions of this scope and scale of expenditure that they could not afford to abandon if the technical picture became negative.

4. The ‘bait and switch’ where one massive set of capital outlays in the ‘best’ shale uncovered was soon to be eclipsed by the recognition of even better shales which required even more outlays before a thorough technical assessment of existing shale positions had been obtained could only be classified as a type of ‘mania’. It has no precedent in financial scale to any of the previous lease plays that experienced a speculative frenzy in domestic onshore petroleum history.

Official at Phoenix Canada Oil Company (2010):

It is my strong view that we will see a near collapse of that play, probably sooner rather than later. Perhaps we will see a repeat of the coal bed methane (CBM) play ‘disappearance’ — where that ‘exciting’ development faded into history ‘without a trace’!

Official from Schlumberger (2010):

All about making money. I’m working on a shale gas well that was just drilled in Europe. Looks like crap, but the operator will flip it based on ‘potential’ and make some money on it. Always a greater sucker….

Flipping is a key part of the dynamic, and not only in relation to the supposed gas potential, but also (if not primarily) the land. The effect on the natural gas sector is in some ways a by-product of yet another form of real estate bubble. When that bubble bursts, the carnage in the natural gas industry will be collateral damage, but with huge impact in a wider economy far more dependent on cheap and abundant natural gas than it realises.

Art Berman:

Returning to the broader subject of shale plays in general, why do operators keep drilling while their own over-production has depressed the price of natural gas by half of its value since January 2010? It seems fairly clear at this time that the land is the play, and not the gas. The extremely high prices for land in all of these plays has produced a commodity market more attractive than the natural gas produced.

The land element is an explicit part of the corporate strategy for gas companies. For instance, consider the transcript of a 2008 conference call between investors and the CEO of Chesapeake Energy, Aubrey McClendon (from the NY Times document trove):

Aubrey McClendon: I can assure you that buying leases for X and selling them for 5X or 10X is a lot more profitable than trying to produce gas for $5 or $6 mcf.

This is how a manic gas market can be temporarily profitable even if gas prices are low. Never mind that the short term gain for the very few comes at the expense of long term pain for the very many. Landowners are not likely to see the lease payments they were promised, investors are likely to see their supposed asset fall sharply in value, lenders will take major losses and the public will find that the low prices brought about by supply complacency do not last. In order to see why, it is necessary to examine the gas bubble in the context of the bigger picture for natural gas in North America.

The best source for this is a recent report entitled Will Natural Gas Fuel America in the 21st Century? by Canadian gas expert David Hughes, writing for the Post-Carbon Institute. A recent interview with Richard Heinberg and David Hughes on Radio EcoShock is also a useful reference. In summary, American natural gas production peaked in 1973.

Despite the advent of the horizontal fracking technology enabling the exploitation of shale gas and other unconventional sources, and a massive increase in well drilling, that peak has not been exceeded. Without new drilling, gas production would decline by 32% in a year.

In the 1990s, 10,000 wells a year were drilled. From 2006-2009 that number had increased to 35,000, but production only increased by 15%. 60% of US production in 2006 originated in wells drilled in the last 4 years, while 50% of 2007 production came from wells drilled in the last 3 years. This is an image of an industry on an accelerating treadmill, and an energy industry in trouble.

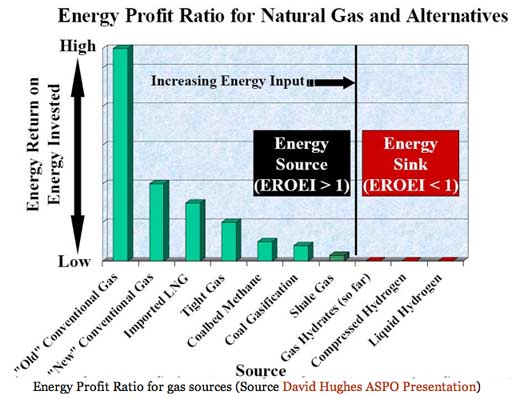

These wells are expensive, in both financial and energy terms, especially before the sweet spots have been defined for a shale play. The fracking process necessary in order to extract gas from very low permeability reservoir rock is complex and has many side-effects that must be expensively dealt with (the subject of a forthcoming post). The water requirements are huge, complicating gas production in arid areas.

The net energy for unconventional gas production is therefore much lower than for conventional supplies. In other words, a much larger fraction of the energy produced must be reinvested in energy production, leaving less as a surplus for society’s other purposes. The steepness of the net energy curve prevents gas from being considered as a long-term, large-scale fuel source.

Nevertheless, the shale gas hype has led to talk of no longer needing Canadian natural gas imports or an Alaskan pipeline, and most preposterously of all to discussion of converting a proposed LNG receiving terminal into an exporting facility. The Department of Energy has called for gas to represent the cornerstone of US energy security, with 45% forecast to come from shale gas by 2035 under the Natural Gas Act 2011.

A substantial increase in electricity generation from natural gas is envisaged, and gas promoters like T Boone Pickens are calling for gas to move into transport on a large scale as well. Very substantial government subsidies are being considered for the shale gas industry, thanks to political vested interests:

Voicing strong support for the natural gas industry, a bipartisan group of eight federal lawmakers from gas-producing states sent a letter to President Obama on Monday asking him to promote continued natural gas development “by any means necessary, but most specifically, by unconventional shale gas recovery.” “The need for the United States to move toward energy independence becomes more crucial as the crisis in the Middle East and North Africa worsens,” the letter said.

Unfortunately, throwing money at a net energy issue will not solve the problem, and in times when money is scarce it will be even more problematic. For production to be maintained, drilling must continually accelerate, but gas prices are so low on the perception of glut that this is exceptionally unlikely. The bursting of the gas bubble will suck most of the project finance out of the sector for a period of time. We can therefore expect gas production to decline sharply in the coming years. Gas declines from a production peak are typically sharper than oil declines, so the change could be quite rapid.

Although demand will soften under the depression conditions for which we are headed, natural gas should receive considerable relative price support in a deflationary environment. The bust part of the cycle is happening earlier than for oil, and by the time we find ourselves in depression, a gas supply crunch could already be underway due to the effects of several years of low prices and so many losses coming home to roost in the aftermath of the shale gas mirage. In North America, gas supply could therefore be a much more immediate concern than oil supply.

Consider one very telling comment from the NY Times trove of shale gas correspondence, which casts light on the shale gas boom in context of the conventional gas situation:

Official from Bold Minerals LLC:

I don’t think the driving force here was just the seductive story of an infinite supply of ‘manufactured gas’ with no risk and assured margins. Nor was it simply the greed of the investment bankers and company executives for fees and windfalls on stock options. Because the thing took off on a wing and a prayer. It was a dubious proposition from the outset.The indicators of a potential disaster which I set out above would be obvious to any senior manager in an oil company. They were flashing warning lights, so why was caution thrown to the wind? Desperation. The conventional exploration game has gotten so tough domestically that managements were willing to grab on to anything that offered a prospect of replacing reserves.The outlook for conventional exploration is just so grim domestically and the carefully concealed pessimism was so profound at most companies the shale story took hold because it offered a hope to domestic companies of ending the death spiral of continual declining production and enormous losses on failed exploration projects.

An energy crisis is not a distant possibility, but a very real threat over the next few years, likely beginning with natural gas. We are in for a shock.